GOODS AND SERVICES TAX (GST)

CBEC PRESCRIBES GUIDELINES FOR CLAIMING REFUND OF IGST PAID ON EXPORT OF GOODS

After the introduction of the Goods and Services Tax (GST) effective 1 July 2017, compliance procedures for the export of goodsand money is receivable in Convertible Foreign Currency and refund of IGST paid on such exporthas been a matter of concern of the exporters. In India,

Exports are treated as zero-rated supplies.

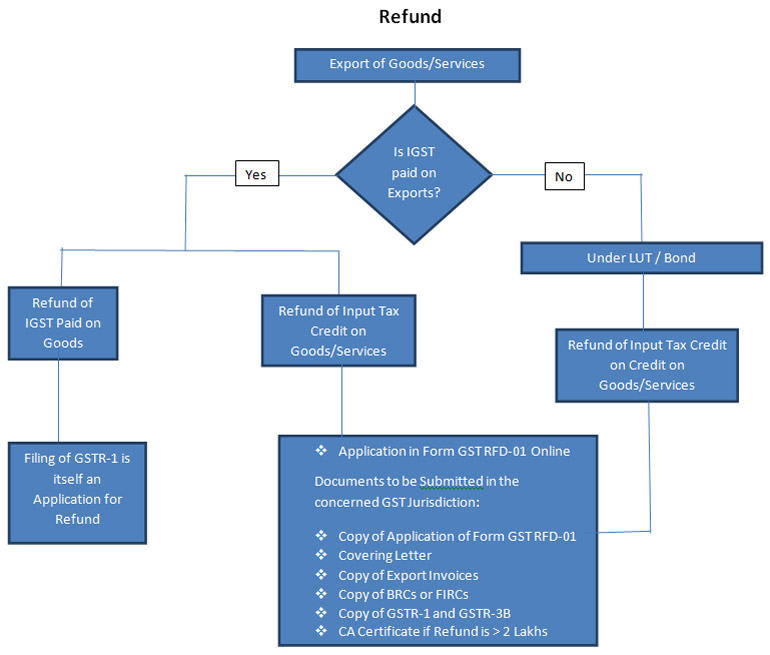

TAXPAYERS WHO EXPORT GOODS OR SERVICES CAN CHOOSE ANY OF THE FOLLOWING OPTIONS:

Export under bond/ Letter of Undertaking without payment of tax and claim refund of Input Tax Credit or

Pay *IGST after setting-off ITC and claim the refund of tax paid.

BACKGROUND

Rule 96 of the Central GST Rules provides that the shipping bill filed by an exporter shall be deemed to be an application for refund of the IGST paid on exported goods once the Export General Manifest(EGM) and valid return In Form GSTR-3 or Form GSTR-3B has been filed.

Pay *IGST after setting-off ITC and claim the refund of tax paid.

WITHHOLDING OF REFUND

If the refund amount is required to be withheld in accordance with the provisions of the GST Act or Customs Act, the proper officer of integrated tax at the Customs station has to intimate withholding of refund to the applicant.

Guidelines and procedures for the filing and processing of refunds of IGST paid on exports done under manual (non-EDI) shipping bills shall be communicated separately.

BANK ACCOUNT DETAILS

The refund claim shall be credited to the bank account of the exporter registered with Customs even if it is different from the bank account of the applicant mentioned in the registration details.

Exporters may either change the bank account declared to Customs to align it with their GST registration details or add the account declared with Customs in their GST registration details.

As refund payments are routed through the Public Finance Management System (PFMS) portal, exporters must get the bank account details validated by PFMS.

IMPLICATIONS

Steps taken by the Government will provide needed relief to exporters who paid IGST at the time of the export of goods but could not claim a refund due to system issues.

The Government also issued similar instructions for granting refunds to exporters who have exported goods or services under a Bond/Letter of Undertaking or exported services by paying IGST.

Online processing of refunds with electronic cross-matching of information with Customs is expected to reduce paperwork and expedite the granting of refunds.