TDS Return

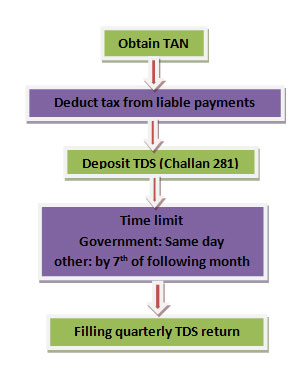

TDS is one of the technique of collection of taxes in which a person making or crediting payment to someone has to deduct a certain percentage of amount from that amount. TDS is like a prepaid tax which is paid to govt. in advance. TDS amount is deposited by the Deductors to govt. account by the 7th of following month in which such amount is deducted. Since TDS is deposited by the Deductors to govt. accountant on regular interval, it ensures regular inflow of cash resources to the Government.

Who Is Liable To Deduct Tax At Source (TDS)?

Income Tax Act requires specified persons to deduct tax on particular types of payments being made by them. The list of such persons requiring making TDS is incorporated in TDS provision listed here. The following are the specified person who is liable to deduct TDS.

An Individuals or an H.U.F. is not liable to deduct TDS on such payment except where the individual or H.U.F. is carrying on a business/profession where accounts are enforce to be audited u/s 44AB, in the immediately preceding financial year.

TAN is an alpha numeric 10 digits number. Every person who is accountable to deduct tax at source must obtain TAN no. from the department in form no. 49B within one month from end of the month in which tax was deducted. TAN is needed to be mention on every transaction related to TDS. There is a penalty of Rs. 10000 on failure to apply TAN